TradingView Auto-Trading Bot

Python-based algorithmic trading system for real-time execution

The Problem

Manual trading based on TradingView signals was slow and error-prone. Traders often missed optimal entry/exit points, and execution discipline suffered due to delays and emotional decision-making.

- Slow manual order execution missing critical market opportunities

- Emotional trading leading to inconsistent strategy implementation

- Human errors in order sizing and position management

- Inability to trade 24/7 across multiple timeframes and assets

- Lack of systematic risk management and trade documentation

The Solution

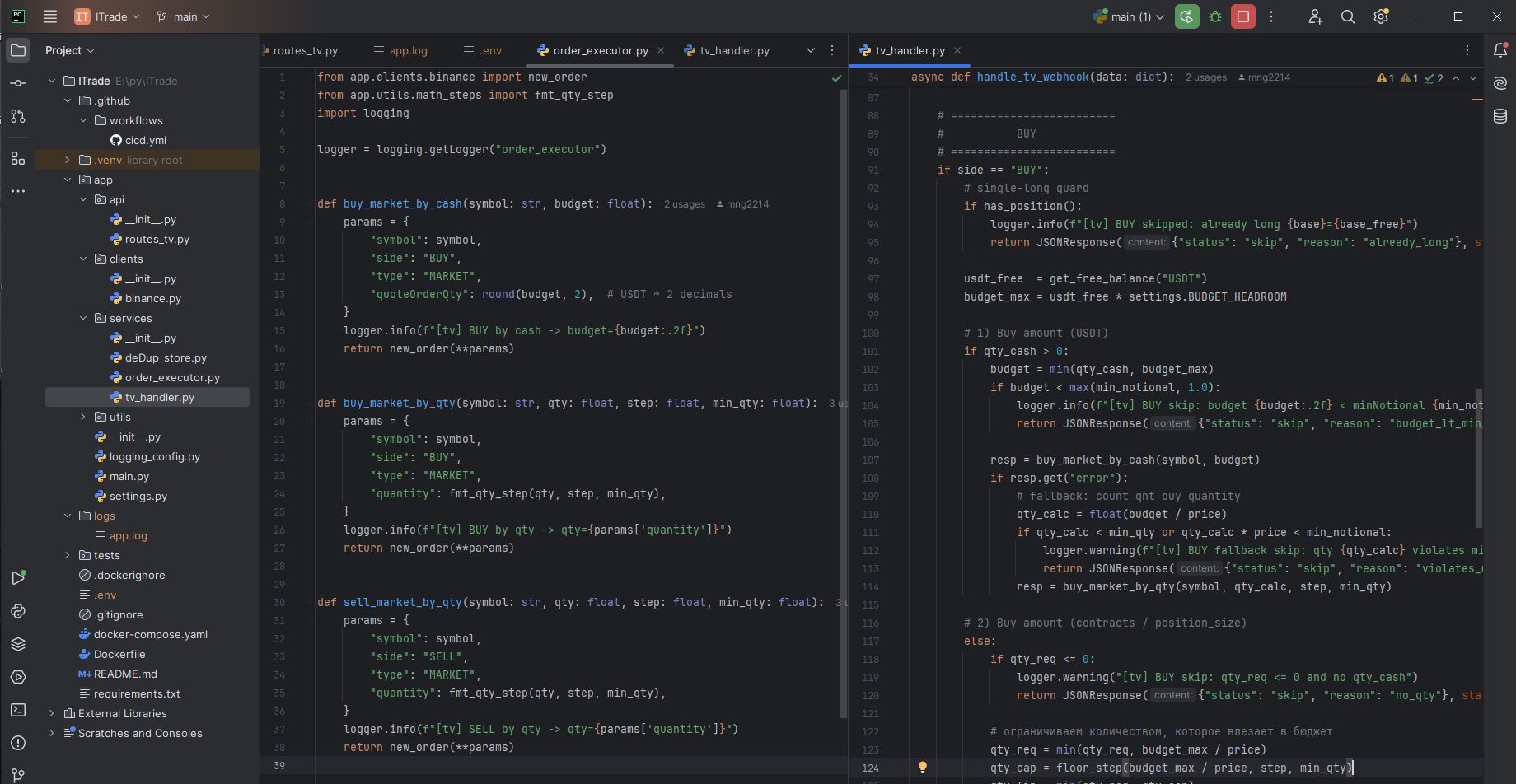

I developed a fully automated Python trading bot that connects TradingView alerts with broker/exchange APIs. The system executes trades in milliseconds, eliminates emotional bias, and provides comprehensive risk management.

Key Features

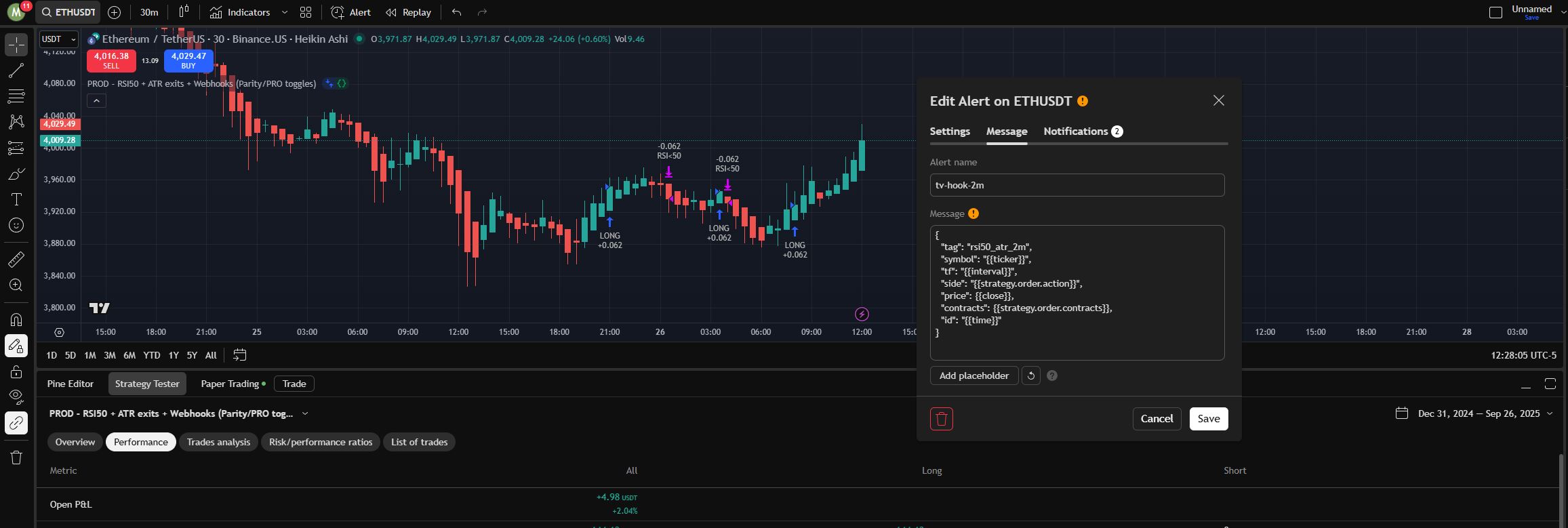

Webhook Listener

FastAPI service instantly receives TradingView alerts with HMAC authentication security.

Multi-Exchange Support

Integrated with Binance, Alpaca, Interactive Brokers APIs for flexible trading.

Strategy-Agnostic

Works with any TradingView PineScript strategy that can send webhook alerts.

Risk Management

Automatic stop-loss, take-profit, position sizing, and daily loss limits.

Trade Logging

Comprehensive trade history stored in PostgreSQL with performance analytics.

Real-time Alerts

Telegram/Discord notifications for trade execution and system events.

Technical Implementation

Technology Stack

Backend & Core

Exchange Integrations

Database & Storage

Infrastructure

Monitoring & Comms

Trading Flow Architecture

- TradingView PineScript strategy generates signals → sends HTTPS webhook alerts

- FastAPI webhook endpoint validates and authenticates incoming alerts

- Order manager processes signals → calculates position size and risk parameters

- Exchange API connector executes market/limit orders with error handling

- WebSocket streams provide real-time market data and order updates

- PostgreSQL database logs all trades, executions, and performance metrics

Risk Management System

- Dynamic position sizing based on account equity and risk tolerance

- Automatic stop-loss and take-profit order placement

- Daily/weekly loss limits with automatic trading suspension

- Maximum drawdown protection and correlation risk controls

- Real-time P&L monitoring with emergency stop mechanisms

Security & Reliability

- HMAC authentication for all TradingView webhook requests

- API key encryption and secure credential storage

- Automatic reconnection logic for WebSocket streams

- Comprehensive error handling and exception recovery

- 24/7 monitoring with automatic restart on failure

Results & Impact

The automated trading bot transformed discretionary trading into systematic execution, providing institutional-grade automation for retail traders.

- Reduced order execution time from minutes to under 200 milliseconds

- Eliminated emotional trading and human execution errors completely

- Enabled 24/7 trading across multiple strategies and asset classes

- Provided complete audit trail and performance analytics for strategy optimization

- Scalable architecture supporting multiple traders and strategies simultaneously

Performance Metrics

The system maintained 99.9% uptime with zero data loss, executing thousands of trades with perfect consistency between backtested strategies and live performance.